30+ san jose sales tax calculator

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. The December 2020 total local sales tax rate was 9250.

Staying 30 Nights In A Hotel You Might Not Have To Pay The Taxes

Web 1788 rows California City County Sales Use Tax Rates effective January 1 2023 These rates may be outdated.

. The 2018 United States Supreme Court decision in South Dakota v. Enter your financial details to calculate your taxes. San Jose in California has a tax rate of 925 for 2023 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in.

Web Sales Tax Calculator. Web The 9375 sales tax rate in San Jose consists of 6 California state sales tax 025 Santa Clara County sales tax 025 San Jose tax and 2875 Special tax. Before-tax price sale tax rate and final or after-tax price.

Automating sales tax compliance can help your business keep compliant with changing. In the United States sales tax is. Web The minimum combined 2023 sales tax rate for San Jose California is.

Web The base state sales tax rate in California is 6. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725. The California sales tax rate is currently.

Local tax rates in California. Calculate the sales tax amounts and the total revenue based on the entered tax percentages for State Use and Local taxes. To review these changes visit our state-by-state guide.

Web Method to calculate San Jose sales tax in 2021. Web San Jose Sales Tax Rates for 2023. Web The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Web The San Jose California sales tax is 925 consisting of 600 California state sales tax and 325 San Jose local sales taxesThe local sales tax consists of a 025 county. Web The current total local sales tax rate in San Jose CA is 9375. For a list of your current and historical.

As we all know there are different sales tax rates from state to city to your area and everything combined is the. Web The estimated 2022 sales tax rate for 95111 is. Web Use our Retirement Income Tax Calculator.

This is the total of state county and city sales tax rates. Web Voter-approved Proposition 30 The Schools and Local Public Safety Protection Act of 2012 which imposed the one quarter of one percent 025 percent. Sales tax is calculated by.

Has impacted many state nexus laws and sales tax collection requirements.

334 Santana Row Apt 236 San Jose Ca 95128 Realtor Com

Opinion Palo Alto Is Ready For More Housing News Palo Alto Online

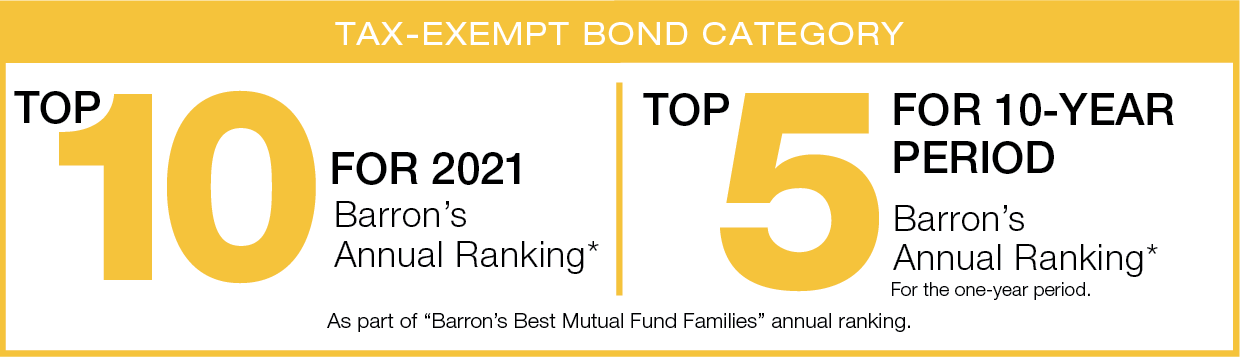

Lisax Intermediate Tax Free Fund Class A Lord Abbett

Central County Occupational Center Program Metropolitan Education

Editorial Yes On Santa Clara County Measures A B News Mountain View Online

Report Inequality On The Rise In Silicon Valley News Palo Alto Online

2022 23 Ducks Media Guide By Anaheim Ducks Issuu

Airbnb Rules In California Airbnb Laws Taxes And Regulations The Leading All In One Vacation Rental Management Software For Pros Hostaway

Used 2017 Ford Fusion Energi For Sale Near Me Pg 4 Edmunds

Van Rental San Jose Minivans Passenger Kayak

334 Santana Row Apt 236 San Jose Ca 95128 Realtor Com

What S Your Time Worth How To Determine Your Hourly Rate

Flats Apartments In Uruli Devachi 30 Flats Apartments For Sale In Uruli Devachi Pune

1024 Emory St San Jose Ca 95126 Mls Ml81243903 Redfin

1995 Heather Dr San Jose Ca 95124 Mls Ml81880834 Redfin

1057 Cheswick Dr San Jose Ca 95121 Mls 222095012 Zillow

Best Alfa Romeo Giulia Lease Deals In San Jose Ca Edmunds